Now a days, we are seeing a new “Innovative” product in the market. They’re called Highest NAV Guaranteed Plans .These products have come in, after the recent crash in the market, and companies are taking advantage of the fact that Investors are looking for some kind of a safe investment equity product. Hence, they’ve launched these Highest NAV Return ULIP’s which confuse investors and make them (the investors  ), believe that they are going to get the highest return from the Stock market in long run – generally the tenure is 7 yrs, for these plans .

), believe that they are going to get the highest return from the Stock market in long run – generally the tenure is 7 yrs, for these plans .

In this article, we look at how Highest NAV Guarantee ULIP’s work, and you will understand, how any Guarantee product can be created by simple methods . The simple catch, here is that these schemes, are structured in such a manner, that the collected funds can be invested either in equities, debt instruments or in money-market instruments in proportions varying from zero to 100%

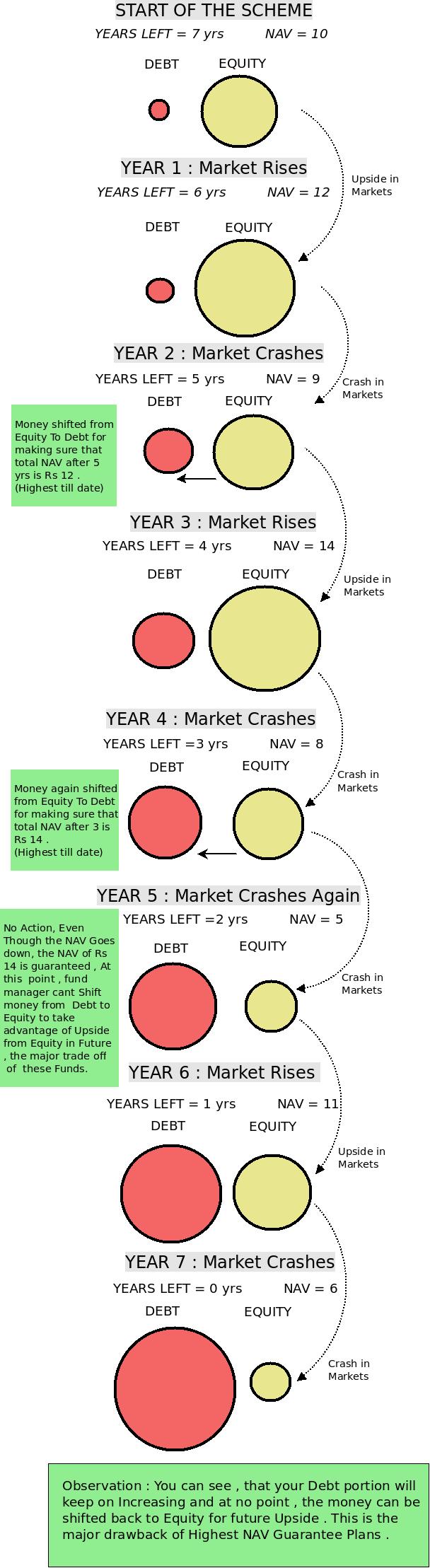

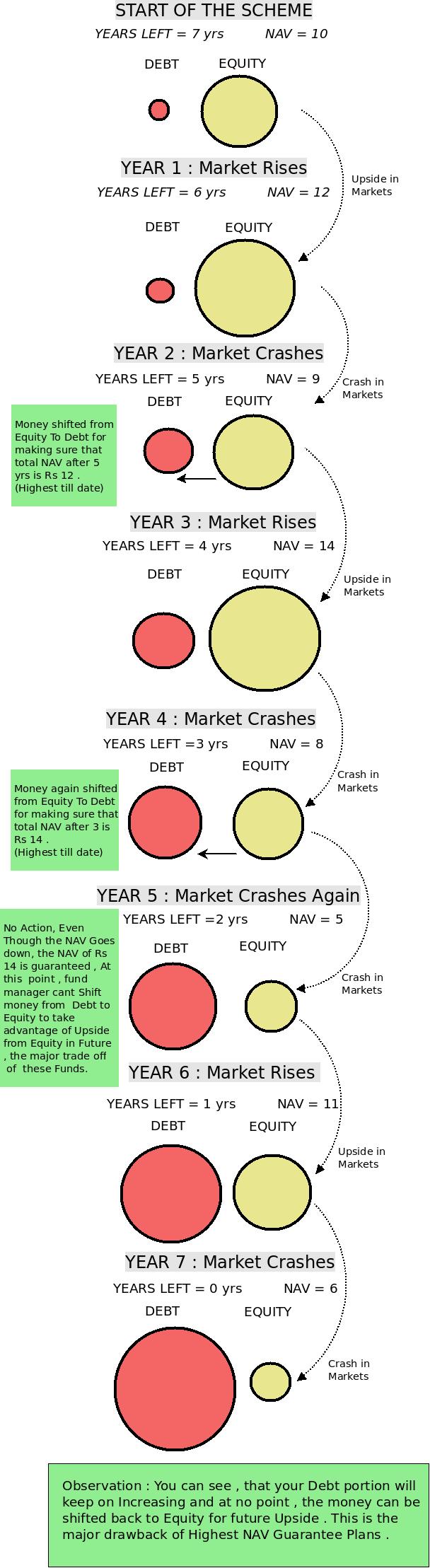

Supposing a policy starts today and is guaranteed to give highest NAV in next 7 yrs and we can control how money moves to debt and equity, its pretty simple.

In the beginning, let’s assume a NAV of Rs 10, and the Asset allocation is 100% in equity and 0% in debt . Now suppose, the market moves up and NAV goes upto Rs 15 by the end of the first year, at this point, try to understand what Insurance company has to provide – they have to make sure, that they provide at least Rs 15 as the return after 6 yrs . Now in order to achieve this, all they have to do is keep X amount in debt instruments which will mature in next 6 years and provide Rs 15 at the end of 6 yrs, so assuming the debt return at 7%, they need to put around Rs 10 in Bonds , so that the maturity of the bond is Rs 15 at the end of 6 yrs .

They can now invest the rest Rs 5 in Equity as Rs 10 is allocated to Debt . So, now they’ve made sure that whatever happens to the market, they get Rs 15 for sure at the end of 6 yrs. Now, there are two possibilities

You will be amazed to know, that the returns expected from these schemes, may be lower than the returns offered by equity-oriented Ulips. The reason being, that the basic objective of protecting the previous high NAV of the fund, may constrain the fund manager’s ability to take risks while allocating funds. So if the market has fallen down, the fund manager can’t take the risk of shifting the money from Debt to Equity to gain from the potential upsides in future , because they have to provide the “Guarantee.”

In this article, we look at how Highest NAV Guarantee ULIP’s work, and you will understand, how any Guarantee product can be created by simple methods . The simple catch, here is that these schemes, are structured in such a manner, that the collected funds can be invested either in equities, debt instruments or in money-market instruments in proportions varying from zero to 100%

How Highest NAV Guarantee Policy Works ?

These plans use strategies like Dynamic Hedging and CPPI (Constant proportion portfolio insurance), which are advanced strategies used in Derivatives world. But, let me explain a simplified version of the whole process.Supposing a policy starts today and is guaranteed to give highest NAV in next 7 yrs and we can control how money moves to debt and equity, its pretty simple.

In the beginning, let’s assume a NAV of Rs 10, and the Asset allocation is 100% in equity and 0% in debt . Now suppose, the market moves up and NAV goes upto Rs 15 by the end of the first year, at this point, try to understand what Insurance company has to provide – they have to make sure, that they provide at least Rs 15 as the return after 6 yrs . Now in order to achieve this, all they have to do is keep X amount in debt instruments which will mature in next 6 years and provide Rs 15 at the end of 6 yrs, so assuming the debt return at 7%, they need to put around Rs 10 in Bonds , so that the maturity of the bond is Rs 15 at the end of 6 yrs .

=> 10 * (1.07)^6

=> 15.007

=> 15.007

Case 1 : Market Goes down : If market goes down, the NAV will go down correspondingly, but as per the strategy, the maturity value will be at least Rs 15.

Case 2 : Market Goes up again : If market goes up at this point and the NAV rises above 15, for example say to Rs. 18, now again they will pull out money from Equity and allocate such an amount to debt, that the maturity at the end of total 7 yrs would be Rs 18 and so on…

Note :- These highest guaranteed schemes do not provide wide range of product categories, such as equity-oriented growth funds, balance funds and debt funds.

- Guarantee on highest NAV is available only if you survive the term. If you die during the term, your nominees will get the prevailing value of the fund. This is inferior to even a regular debt product because of the high cost structure involved.

How Investors get Confused

You have to read in between the lines; Investors need to understand that these schemes guarantee the “Highest NAV”, READ AGAIN! , it’s Highest NAV and not “Highest Returns” . Normal Investors don’t give much thought before buying these products and normally assume that the returns will be linked to the Equity Markets .Returns from Highest NAV Guarantee Plans

So, what are the return expectations of these funds? We know, that long-term equity returns, are normally in the 12-15% range while, debt returns turn out to be 6-7%. So, considering the fact, that these products will shift most of their money to debt, by the end of the tenure , we can expect the returns to be in range of 9-10%. We do get some equity upside in these products, but that will be limited. After a point, this product will turn into a debt oriented fund with a major portion in debt . Also if you factor in costs, like premium allocation charges , fund management charges and other yearly charges, the returns will not be what you actually expect.You will be amazed to know, that the returns expected from these schemes, may be lower than the returns offered by equity-oriented Ulips. The reason being, that the basic objective of protecting the previous high NAV of the fund, may constrain the fund manager’s ability to take risks while allocating funds. So if the market has fallen down, the fund manager can’t take the risk of shifting the money from Debt to Equity to gain from the potential upsides in future , because they have to provide the “Guarantee.”

No comments:

Post a Comment